Which Camera Mounts Will Survive?

As always, Tony Northrup is someone whose opinions I respect. Here are his predictions on which mounts will survive and which will not.

A summary of the points with predictions based on sales points can be found at the Mirrorless Rumors website. The analysis is based on sales data from Amazon US data and CIPA Japanese data. Tony's strength is that he typically has data to back his analyses up.

I am going to counter a little with respectful counter-analysis of his views. First, the things that back him up. Sales of Sony mirrorless cameras are topping the sales lists of nearly all major Japanese sales outlets.

Yodobashi camera sales 1st June to 15th June 2019:

1. Nikon Z 6 24-70+FTZ mount adapter kit

2. Sony α7Ⅲ body

3. Sony α7Ⅲ lens kit

4. Sony α6400 double zoom lens kit

5. Sony α7RⅢ body

6. Nikon D5600 double zoom kit

7. Nikon Z 7 24-70+FTZ mount adapter

8. Canon EOS Kiss M double zoom kit

9. Nikon D850

10. Canon EOS R

1. Sony α7 III body

2. Sony α7R III body

3. Sony α6400 double zoom kit

4. Sony α7 III lens kit

5. Canon EOS Kiss M double zoom kit

6. Nikon D850

7. Olympus OM-D E-M10 Mark III EZ double zoom kit

8. Canon EOS R body

9. Nikon D5600 double zoom kit

10. Sony α6400 power lens kit

Sony occupies 5 out of 10 top spots for April. The results from Map Camera sales data are similar:

1. Sony α6400

2. Sony α7 III

3. Sony Cyber-shot DSC-RX0M2

4. Nikon Z6

5. Fuji X-T30

6. Canon EOS R

7. Canon IXY200

8. Ricoh GR III

9. Sony α9

10. Canon EOS RP

There is no doubt that Sony is currently making a big impact on the camera marketplace. It is the cumulative effect of multiple engineering innovations. These include superior sensor performance (ISO, dynamic range) and design (fast readout stacked and copper wired sensors eg α9). Although Fuji, Ricoh/Pentax, and Nikon source sensors from Sony, they only obtain access to the latest sensors with a delay. The Sony camera division gets first pick when it comes to the latest sensor innovations. Canon fans say that the fact that Canon sensors are behind in their dynamic range means little on its own, but add in a whole set of other innovations on top of that (eg eye detect AF, 35mm format mirrorless, IBIS, and faster mirrorless AF performance) and Canon starts to look like it is getting seriously behind.

However, there are problems with the Sony FE mount seen from an optical engineering perspective that will limit its enduring success. Perhaps reflecting the fact that Sony comes from an electronics tradition rather than an optical engineering tradition, the FE mount is optically flawed because it is an APS-C mount (E mount) forcibly retro-converted into 35mm format (FE mount). This defect can be mathematically expressed using the concept of the "value angle", where the greater the value, the easier it is to design lenses for the mount. As you can see the Sony 35mm small format mount is at the bottom of the heap:

That the Sony FE mount is a defective mount is simply a fact not a matter of opinion. Sony took a cheap shortcut and its lead in the mirrorless segment is purely a result of this victory of clever marketing over engineering fundamentals. Canon could have done the same with its APS-C format M mount by converting it into a 35mm format mount but chose not to, and instead took the long way around of arduously starting a new 35mm format mount of optimal optical dimensions from scratch, the RF mount. It took Canon (and Nikon) longer to get into the 35mm format mirrorless market as a result, but the result of their arduous endeavour is a more optically sound mount more conducive to lenses that require fewer corrective elements, having smaller outer lens elements, and better corner optical performance. Canon is definitely the tortoise here and Sony the hare. Canon, Nikon, and Panasonic will be ruthless in exploiting the weaknesses of the 35mm format Sony FE mount. Market share of the FE mount will be slowly eroded threatening the future survival of the mount.

That the Sony FE mount is a defective mount is simply a fact not a matter of opinion. Sony took a cheap shortcut and its lead in the mirrorless segment is purely a result of this victory of clever marketing over engineering fundamentals. Canon could have done the same with its APS-C format M mount by converting it into a 35mm format mount but chose not to, and instead took the long way around of arduously starting a new 35mm format mount of optimal optical dimensions from scratch, the RF mount. It took Canon (and Nikon) longer to get into the 35mm format mirrorless market as a result, but the result of their arduous endeavour is a more optically sound mount more conducive to lenses that require fewer corrective elements, having smaller outer lens elements, and better corner optical performance. Canon is definitely the tortoise here and Sony the hare. Canon, Nikon, and Panasonic will be ruthless in exploiting the weaknesses of the 35mm format Sony FE mount. Market share of the FE mount will be slowly eroded threatening the future survival of the mount.

The Canon and Nikon mirrorless tortoises are working away slowly to close the gap with the Sony hare. There is evidence of this already starting to make an impact. According to Japanese BCN sales data, in the mirrorless segment, Sony still maintains a lead of around 55% market share, compared to 30% by Canon, and 15% by Nikon. There is evidence that Sony's competitors are working hard to close their lead. It should be remembered that Rome was not built in a day, and Sony's α7 series was not an overnight instant success either. The lens options for Canon and Nikon 35mm format mirrorless are still limited. It is true that Panasonic is the outsider, nowhere to be seen in the data, but their native mirrorless lens options are still the most limited of them all (the Sigma lenses have optical designs not optimised for short flange distance mirrorless mounts). It is far too soon to write the L-mount alliance off. In short, as with the Sony 35mm mirrorless system at its outset, it is too early to use the current data to gauge the full long-term impact on the market.

Next issue, the M4/3 segment. My prediction is that this segment has the potential to slowly grow as the technology matures even though Tony Northrup predicts it will die off. Once M4/3 sensors gain in performance, this format could increase in viability as a videography and moving subject photography platform. There are a growing number of sports and wildlife photographers who are finding that airlines are increasingly restrictive of the amount of equipment they can carry, making it necessary to downsize their gear. Once autofocus performance and sensor ISO performance catch up, this trend will continue. Given the growth of videography, this too will make M4/3 more attractive. The objection that M4/3 is too small a sensor format to differentiate itself from smartphones is premature because M4/3 allows users more cost-effective access into the super telephoto lens market, which is exactly the biggest weakness of smartphones (watching smartphone users struggle to shoot wildlife really brought this fact home to me recently). M4/3 makers need to focus more on high-end super telephoto and cine lenses instead of marketing their cameras as vague general purpose devices i.e. specialization and diversification are the key to survival. M4/3 makers need to accept that they cannot sell their cameras as multi-purpose consumer compact cameras which means they have to turn them into niche high-end moving subject photography devices. The Olympus OM-D E-M1X is a nice attempt at pushing M4/3 into the high-end bracket, but the fast super telephoto and cine lenses to support it are lacking. In the marketplace as in Nature, the survival of the fittest means you need your niche. As competition heats up, there is an escalating urgency to differentiate or die.

The next thing M4/3 makers need to give up on is the idea that they should start at the bottom of the mass consumer market and wait to see if it gains acceptance there before working their way upwards to the high-end market. All this does is put them on a collision course with phone cameras, which can only doom them to failure. Instead, they need to forget the mass consumer compact camera market and go straight upmarket just to survive.

|

| The Olympus OM-D E-M1X successfully gives up on the idea of M4/3 cameras being compact cameras Image: Olympus |

|

| The OM-D E-M1X is almost the same size as a medium format camera Image: camerasize.com |

|

| M4/3 need to stop undermining themselves by marketing their system as being excessively small. They need much more high-end glass eg a 300mm f2.2 to 2.8, 400mm f/2.8 Image: Olympus |

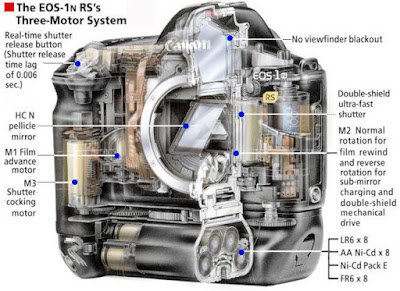

Third issue: the future of the "DSLR". This too has been discussed before. My prediction is that 80-90% of the market will move to mirrorless systems over the next 10-15 years. DSLRs will need to move from optical (OVF) to electronic viewfinder (EVF) camera systems. This will mean most users will use ML-EVF (mirrorless EVF) cameras leaving PM-EVF (pellicle mirror EVF) cameras as speciality cameras for niche fast action photography usage. The problem is that EVFs may still be too primitive to be able to eliminate perceptible viewfinder lag to be able to replace OVFs for serious moving subject photography, though that will eventually happen once EVF technology matures. That means OVF-DSLRs certainly are dead, but that is because they will be replaced by PM-EVF cameras. The real change in the market, from an engineering perspective, is not from cameras with mirrors to cameras without mirrors, but from OVF cameras to EVF cameras.

I thus politely take issue with the statement made by Tony that mirrorless EVF cameras enjoy the unique advantage of live exposure preview and eye-detect AF. Both of these features can be put into PM-EVF cameras. My Sony a99II has them. Even some OVF-DSLRs like Canon's Rebel line already have eye-detect AF.

The biggest problem with the CaNikon 35mm format DSLR segment is that it is questionable how much longer professional moving subject field photographers are going to be shooting in 35mm format. My prediction is that they will move to M4/3 and APS-C formats to reduce the amount of carry-on luggage they have to check in to planes. As I have stated before, 35mm format is going to become the medium format of the moving subject field photography world. If you can tolerate carrying the extra weight to get better images, that is fine, but you are going to get comparable results from a smaller format without breaking your back or blowing your carry-on weight limits. Panasonic should maintain M4/3 as their field camera system and promote their 35mm system as a sort of mini-medium format high-resolution system for studio usage.

The biggest problem with the CaNikon 35mm format DSLR segment is that it is questionable how much longer professional moving subject field photographers are going to be shooting in 35mm format. My prediction is that they will move to M4/3 and APS-C formats to reduce the amount of carry-on luggage they have to check in to planes. As I have stated before, 35mm format is going to become the medium format of the moving subject field photography world. If you can tolerate carrying the extra weight to get better images, that is fine, but you are going to get comparable results from a smaller format without breaking your back or blowing your carry-on weight limits. Panasonic should maintain M4/3 as their field camera system and promote their 35mm system as a sort of mini-medium format high-resolution system for studio usage.

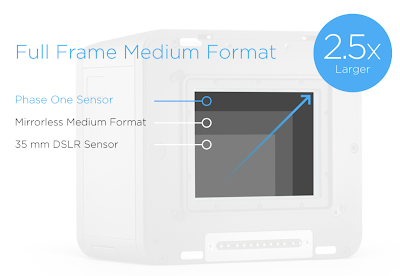

Fourth issue: medium format. I tend to argue that as the digital camera market matures, it will become more specialized and differentiated. Reviewers who made their mark in the last 10-15 years may still think in terms of general use cameras being the gold standard for comparison, but a larger segment of the market will be for niche users. Tony Northrup seems to mostly do wildlife and travel photography, and this is not the strength of medium format systems, so his views on medium format merely reiterate that medium format doesn't suit his particular niche requirements. In actuality, speciality systems will be on the rise, and Fujifilm has been smart in having gone early down this track. Fuji states that after the release of the GFX50s, the medium format market grew from one to two per cent of market share. This is likely to double again over the same time period of around 3-4 years to 4%, and again to around 8% in the coming 4-6 years after that.

Disclaimer: no industry conflicts of interest to declare. No sponsorship. I am not an M4/3 shooter, nor a Canon R, Nikon Z, or Panasonic L mount mirrorless user (nor do I have any plans to become one).

Comments

Post a Comment